Financial Modeling

Financial Modeling is indispensable for organizations seeking to make informed financial decisions, assess investment opportunities, and forecast future performance. Stonehill's Financial Modeling Consulting Services equip businesses with robust, detailed models that provide insights into financial viability, profitability, and risk. Our team of financial experts combines technical prowess with strategic insight, employing advanced modeling techniques to support decision-making processes, strategic planning, and investment analysis.

Services:

Financial Forecasting and Projections - Accurate forecasting is crucial for planning and strategic decision-making. Stonehill's Financial Forecasting and Projections service utilizes historical data, industry trends, and economic indicators to create comprehensive models that predict future income, expenses, and cash flow, enabling businesses to plan for growth, manage risk, and secure financing.

Investment Analysis and Valuation - Evaluating investment opportunities and understanding their value are key to strategic expansion and portfolio management. Our Investment Analysis and Valuation service provides detailed assessments of potential investments, including mergers, acquisitions, and new ventures, offering insights into their financial implications, risks, and opportunities.

Scenario and Sensitivity Analysis - The business environment is fraught with uncertainties. Stonehill’s Scenario and Sensitivity Analysis examines the impact of various assumptions and external factors on financial outcomes, helping businesses understand potential risks and prepare for different scenarios, thereby facilitating more resilient strategic planning.

Capital Structure and Funding Strategy - Optimizing the capital structure and developing effective funding strategies are essential for financial stability and growth. Stonehill advises on the mix of debt, equity, and other financing sources best suited to your business goals, providing models that help evaluate different funding options and their implications for financial health and flexibility.

Budgeting and Financial Planning - Effective budgeting and financial planning are foundational for operational excellence and financial control. Stonehill's service in this area assists organizations in developing detailed budgets that align with strategic goals, along with financial plans that guide resource allocation, cost management, and profitability improvement efforts.

In today's complex and volatile financial landscape, Stonehill's Financial Modeling Consulting Services are your strategic asset for navigating financial challenges and seizing opportunities. Our bespoke financial models serve as a powerful tool for forecasting, investment analysis, risk management, and strategic financial planning. By partnering with Stonehill, you gain access to the expertise and insights necessary to make data-driven decisions, optimize financial performance, and propel your organization toward sustainable growth. Let Stonehill guide your financial strategy with precision and insight, unlocking your business's full potential.

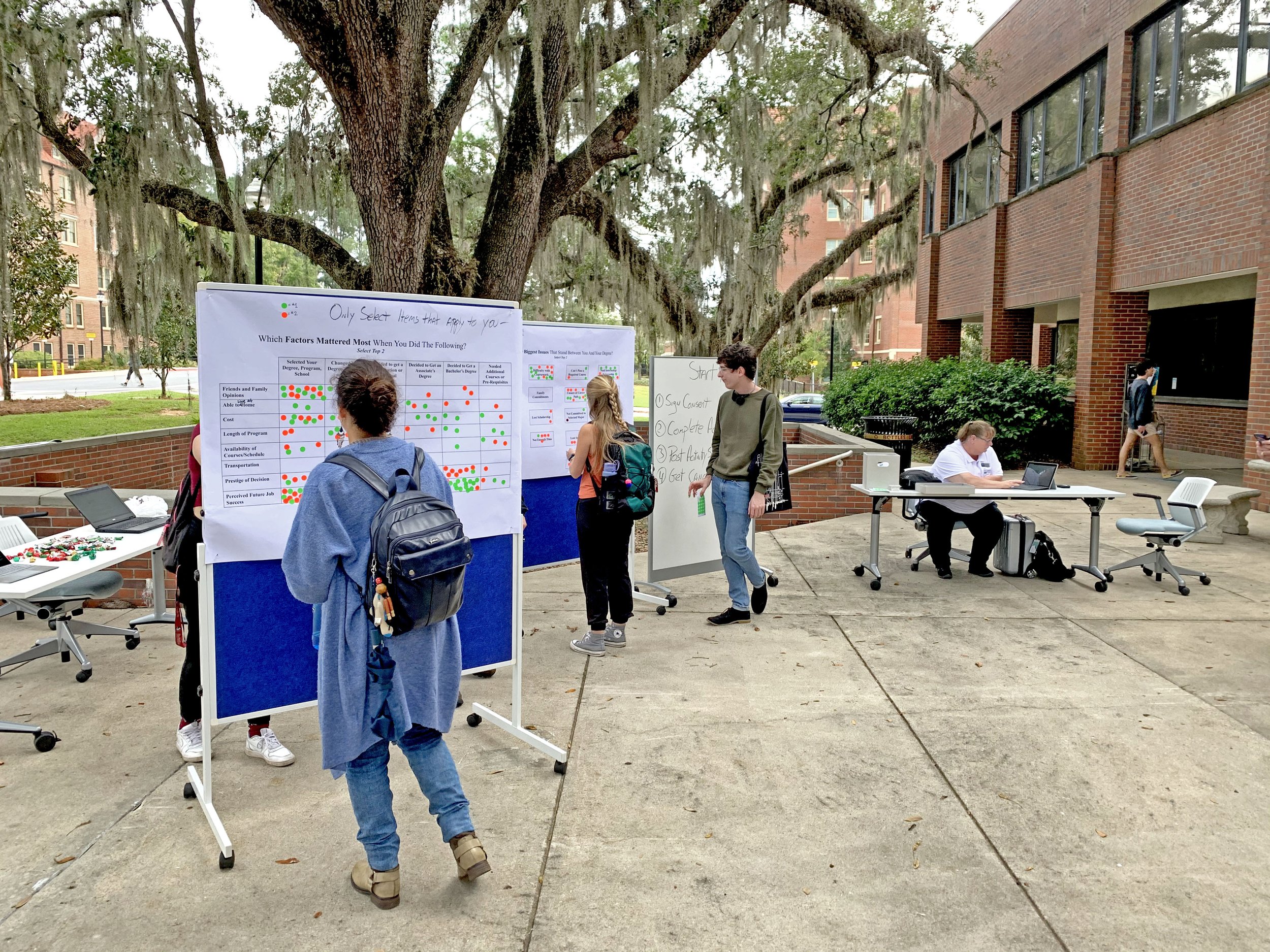

Download our free, printable Guide to Design Thinking!

Design Thinking is one of the most valuable problem-solving methodologies an organization can adopt. The Stonehill team created the most simple and effective guide to arriving at human-centric business solutions, all based on our proven-to-work everyday Design Thinking practices.

This guide features different canvases with tutorials that walk you through the Design Thinking process in the most practical way. Fill out the form to immediately access Stonehill’s simple guide to Design Thinking and begin your team’s journey to empathetic problem-solving!

Learn more about Design Thinking: Stonehill’s guiding methodology.